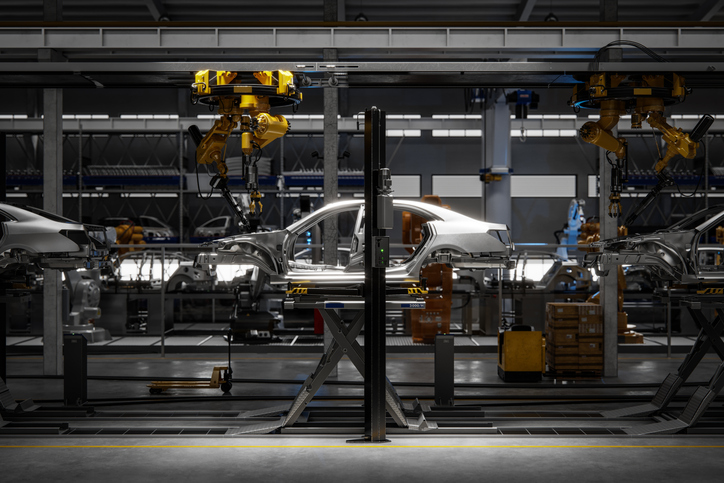

Germany’s industrial workforce has shrunk significantly over the past year, with the automotive sector facing the most severe losses, according to new data released by the Federal Statistical Office (Destatis) on Thursday.

At the end of the third quarter of 2025, the automotive industry employed more than 48,700 fewer people than a year earlier, a decline of 6.3 percent — the steepest drop among all major industrial sectors with more than 200,000 employees.

With 721,400 people employed, the sector’s headcount has fallen to its lowest level since the second quarter of 2011, when it stood at 718,000. Despite the contraction, the automotive industry remains Germany’s second-largest industrial employer, behind mechanical engineering, which counted roughly 934,200 employees at the end of the third quarter.

Across the manufacturing sector as a whole, around 5.43 million people were employed — a year-over-year decrease of 120,300, or 2.2 percent.

Suppliers have suffered the deepest cuts within the automotive sector. Vehicle and engine manufacturers employed 446,800 people, down 3.8 percent from the previous year. Employment in the body and trailer manufacturing segment fell by 4 percent to 39,200. The sharpest contraction occurred among producers of parts and accessories for motor vehicles, where employment declined by 11.1 percent to just under 235,400.

Job cuts have also spread across most other major industrial sectors. Metal production and processing recorded a 5.4 percent decline, leaving 215,400 employees at the end of the third quarter. Employment in the manufacture of data processing, electronic, and optical equipment fell 3 percent to 310,300. The plastics industry saw a 2.6 percent contraction to 321,400, while manufacturers of metal products recorded a 2.5 percent drop to 491,500.

Mechanical engineering experienced a decline in line with the industry average, with employment falling 2.2 percent to around 934,200. Some sectors saw milder cuts: The chemical industry contracted by 1.2 percent to 323,600 employees, and employment in the manufacture of electrical equipment dipped 0.4 percent to 387,500.

In der #Industrie wurden zuletzt viele Stellen abgebaut. Besonders betroffen ist die #Automobilindustrie. Zum Ende des 3. Quartals 2025 arbeiteten dort 6,3 % oder 48 700 weniger Beschäftigte als ein Jahr zuvor. Mehr zur Beschäftigtenzahl in der Industrie: https://t.co/pxTueAI8f5 pic.twitter.com/TR7D3nPi59

— Statistisches Bundesamt (@destatis) November 20, 2025The food industry stands out as the only major industrial sector to register job growth. Employment rose by 8,800, or 1.8 percent, reaching 510,500 workers at the end of the third quarter.

Destatis notes that while the automotive sector remains a cornerstone of German industry, the scale of recent job losses marks its weakest employment level in 14 years.

In recent years, the overall picture for the German economy has been one of stagnation. Over the past eight quarters, four have seen contractions, including zero growth in Q3 and -0.2 percent in Q2 of 2025.

Although the country is not technically in recession currently — this requires two consecutive quarters of growth contraction — business leaders have sounded the alarm and called for radical measures from the CDU-led coalition government to arrest the crisis.

In August, Germany’s Chamber of Commerce and Industry (DIHK) sent a serious warning to Chancellor Friedrich Merz, arguing that “things cannot go on like this.”

“The German economy is deeper into the crisis than many people want to see,” CEO Helena Melnikov wrote.

“As before, it cannot go on. It is crucial that productivity and economic performance grow faster than social spending,” she warned.

According to her, “this cannot be achieved through tax increases, but only through structural reforms. In a situation where billions in loans are already being taken out, the tax increase is a completely wrong signal.”