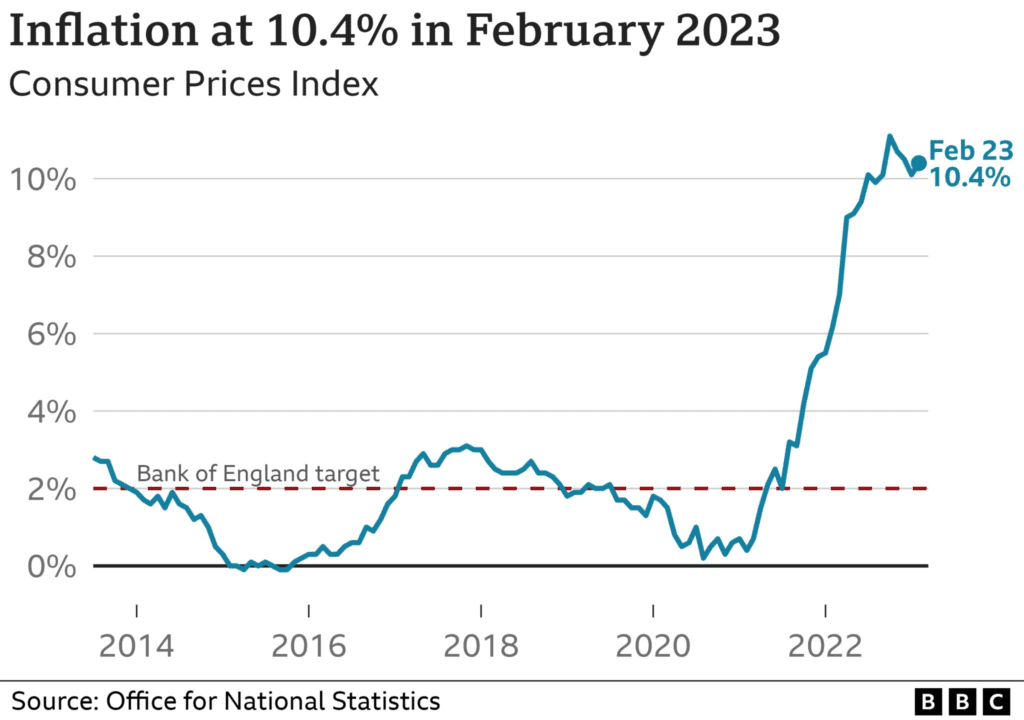

The U.K. economy suffered a setback on Wednesday with the announcement that inflation has risen to 10.4 percent, undoing the gradual month-by-month decreases the country had experienced since last October’s 41-year high.

The Consumer Price Index (CPI) was up by 0.3 percentage points over January, with the Office for National Statistics attributing the climb to “price rises in the restaurants and hotels, food and non-alcoholic beverages, and clothing and footwear divisions.”

Prices have risen in British restaurants and cafes by 11.4 percent year-over-year for February, up from 9.4 percent in January, with the main price increases being in alcohol.

Inflation for food and non-alcoholic beverages, however, is also cause for concern, with prices up 18.2 percent year-over-year for February, up from 16.8 percent in January, an annual increase the ONS states is “the highest observed for over 45 years,” dating back to August 1977.

A vegetable shortage last month, which led to some British supermarkets imposing rations on salad items such as lettuce, tomatoes and cucumbers, also drove up prices, as well as the cost of clothing, particularly for women and children.

The unexpected increase was announced ahead of an announcement by the Bank of England on Thursday regarding a possible hike in interest rates. The figure exceeds both the Bank of England’s forecast and projections by City economists, which both predicted the February inflation rate would fall into single digits at 9.9 percent for the first time since August last year.

The news is bad timing for Conservative Prime Minister Rishi Sunak who, just hours after the latest ONS publication, told the House of Commons: “We are getting on. We are halving inflation,” a statement met with much derision on the opposition backbenches.

Chancellor Jeremy Hunt told the House of Lords Economic Affairs Committee on Tuesday that he “regularly” discusses the topic of inflation with Bank of England Governor Andrew Bailey, and remained adamant that government policy will see the cost-of-living crisis soften in the coming months.

“(Inflation) is over 10 percent at the moment, that’s dangerously high, and we need to do everything we can to maintain our focus on bringing it down,” Hunt told the committee.

“So I only ever say to (Andrew Bailey), please do what you think is necessary, as indeed you are legally bound to do under the Bank of England Act.”

Economists will be hoping the spike is something of an anomaly, with many predicting inflation will soon fall in line with the Bank of England’s target of 2 percent, a projection outlined last month in a paper published by Prof. Huw Dixon of the National Institute of Economic and Social Research.

For now, Britain retains the highest level of inflation experienced among the world’s richest nations, slightly above Italy’s 9.8 percent and Germany’s 9.3 percent, and considerably higher than the 6.4 percent reported in the U.S. and the 4.2 percent in Japan. It also remains higher than the 8.5 percent reported in the eurozone in February, down from 8.4 percent in January.