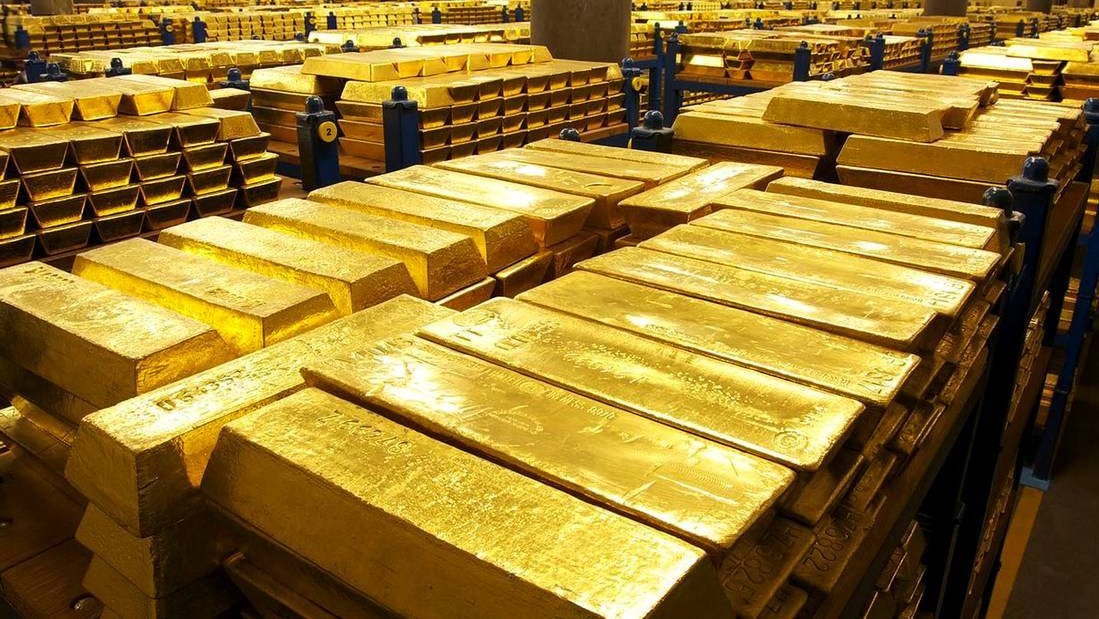

The National Bank of Poland (NBP) has steadily increased the country’s gold reserves, a move that has bolstered the Polish złoty as gold prices have surged.

On Wednesday, the NBP announced that its gold reserves reached 12.593 million ounces by the end of July, up from 12.133 million ounces the previous month. The central bank also reported that total official reserve assets stood at €190.535 billion at the end of July, slightly down from €195.515 billion a month earlier.

In June, NBP President Adam Glapiński revealed that the bank purchased 5 tons of gold this year and intends to continue buying until gold comprises 20 percent of the country’s foreign reserves, up from the current 13 percent.

Last year, the NBP purchased a record 130 tons of gold, so while this year’s acquisitions are smaller, the impact remains significant. Gold prices have surged 23 percent in U.S. dollar terms since the beginning of the year, breaking the barrier of $2,500 per ounce.

Poland leads global gold purchases in 2024, surpassing India, Turkey, Uzbekistan and the Czech Republic. With nearly 392 tons of gold, Poland now ranks 15th worldwide in gold holdings.

The increased gold reserves have tangible benefits: the złoty is now at its strongest against the euro since October 2008, further supported by the high gold coverage of the currency compared to the euro.