The number of bankruptcies across the European Union rose to record levels in the fourth quarter of last year, as soaring energy bills and high inflation led to insolvency for thousands of businesses.

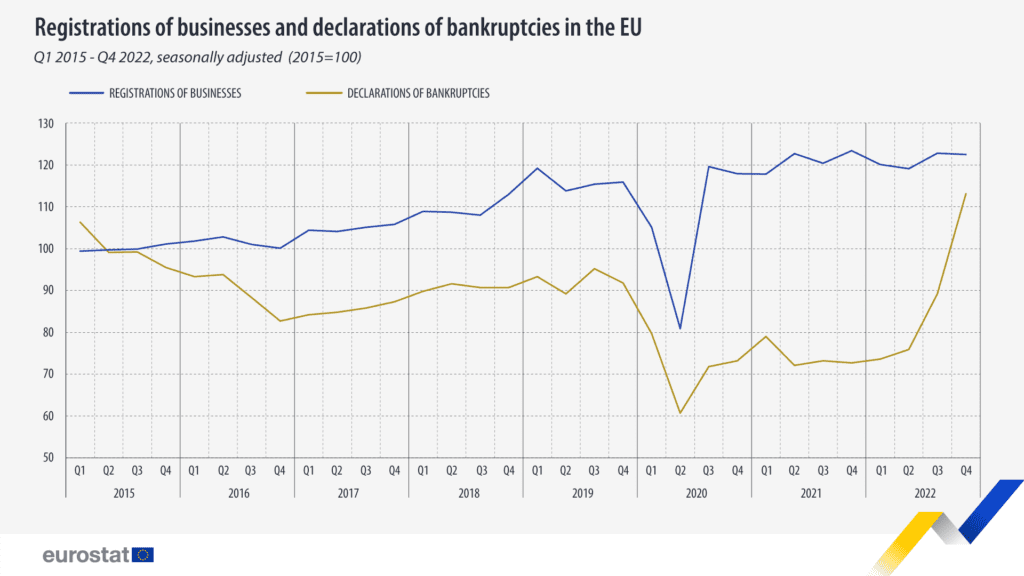

A report published last month by Eurostat revealed bankruptcies throughout the bloc increased by 26.8 percent compared with the previous quarter, reaching the highest level on record.

Bankruptcies increased in all four quarters of last year, while registrations of new businesses decreased slightly by 0.2 percent in Q4 compared to Q3 in 2022. New business registrations, however, remained high, surpassing figures recorded before the Covid-19 pandemic.

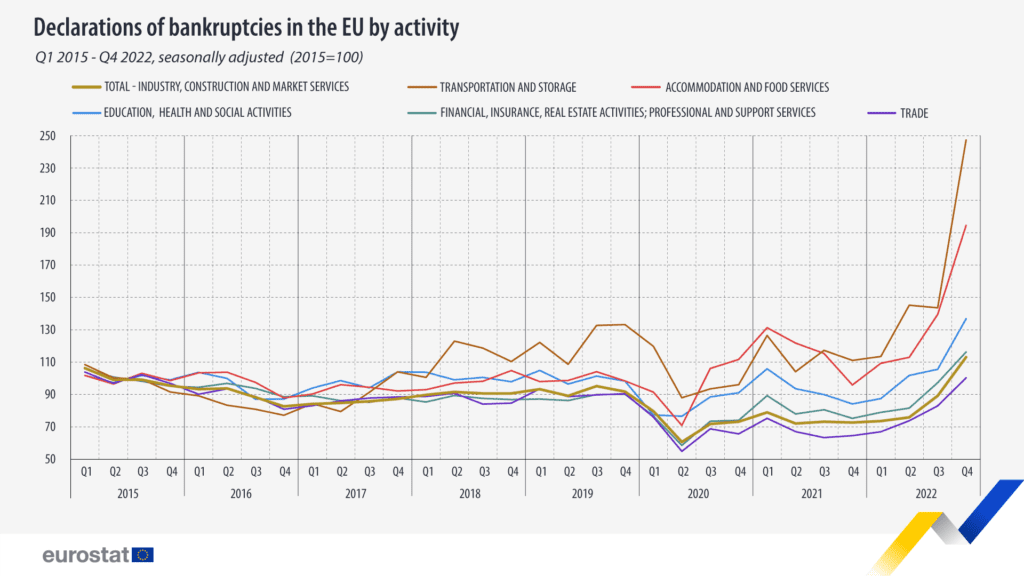

Bankruptcies rose in all sectors, but companies in the transportation and storage industries, as well as accommodation and food service sectors, performed particularly poorly, with insolvency petitions rising by 72.2 percent and 39.4 percent, respectively.

Health and social activities businesses also recorded an increase in bankruptcies of 29.5 percent.

Bankruptcies in France jumped by 50 percent in total, while the number of small and medium-sized businesses (SMEs) filing soared by 78 percent last year, with more than 30 percent of these filing in Q4, according to Altares, a commercial data company in France.

Bankruptcies in Belgium were also particularly noticeable, with a 44 percent annual rise, while in Brussels, 1 in 101 businesses filed for insolvency last year.

BusinessEurope’s Director General Markus J. Beyrer called the increase “alarming.”

“It is the highest rate of bankruptcies in the EU since data on these started to be collected. The air to breathe is becoming increasingly tight, especially for small and medium-sized enterprises. Many bankruptcies have been artificially postponed due to government support measures in the wake of the coronavirus pandemic; these are now coming to an end.”

He added the reason behind the trend was three-fold: high energy costs, high material and production costs, and rising labor costs.

“When government support becomes weaker and wages and financing costs climb, the companies that are struggling for survival will find it a mission impossible,” added Ludovic Subran, chief economist of Allianz.