The National Bank of Poland (NBP) increased its gold reserves for the fourth consecutive month in July as the country continues to aggressively stockpile the precious metal.

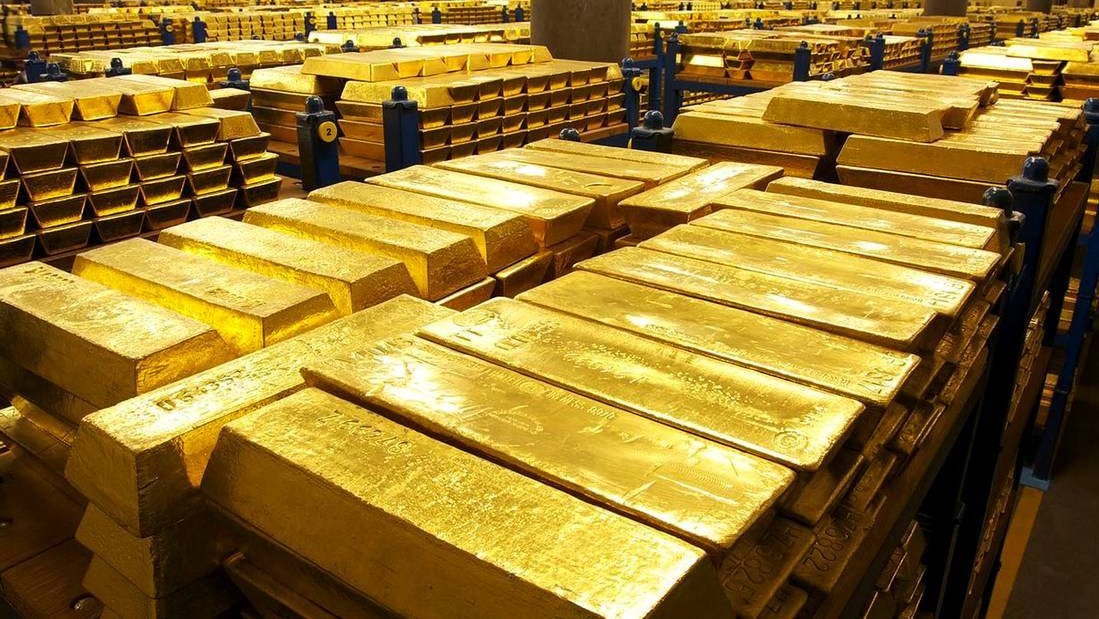

According to calculations by the DGP newspaper, 720,000 ounces of gold were bought last month, valued at about $1.4 billion. This is more than in any of the previous three months. The paper estimated that the total gold reserves held by the Polish central bank have increased to 9.6 million ounces, or nearly 300 tons.

Since the beginning of the year, the NBP has increased its gold supply by 2.3 million ounces. Before starting his second term as the president of the NBP, Adam Glapiński announced that he would increase gold reserves by 100 tons. With this year’s purchases, he has already fulfilled over two-thirds of that promise.

Monetary gold held by the NBP was valued at $18.8 billion at the end of July. It accounted for 10.4 percent of the central bank’s official reserve assets. In the local currency, the gold held by the central bank was valued at 75.3 billion złotys.

Foreign currency reserves are primarily meant to ensure the financial stability of the economy. That’s why the money is invested in safe and liquid assets, meaning those that can be quickly sold. However, they should also generate income.

Since the beginning of this year, gold prices in global markets have increased by over 6 percent. It currently costs just over $1,900 per ounce. In terms of return rate since the beginning of the year, gold has performed the best among the main metals.

Silver has depreciated by 2.2 percent and platinum by 15 percent. The rise in gold prices has in part been due to buying it as a way to hedge against inflation.