Poland’s lithium-ion battery production sector reached the value of €8.1 billion (38 billion zloty) in 2022, according to the Polish Alternative Fuels Association (PSPA).

To maintain its position as a major player in electric car battery production, the country requires raw materials, qualified personnel, and innovation, the association claimed.

Poland currently plays a leading role in the battery supply chain, with lithium-ion batteries accounting for over 2.4 percent of all Polish exports. The battery sector’s value has increased 38-fold in the last six years, from around €210 million (1 billion zloty) in 2017 to over €8.1 billion (38 billion zloty) in 2022. Leading companies investing in Poland’s battery sector include LG Energy Solution, Northvolt, Umicore, SK Innovation, Capchem, Guotai Huarong, BMZ, and Mercedes-Benz Manufacturing Poland.

The PSPA report highlights three essential areas to strengthen the battery sector in the Central European region: increasing domestic capabilities in raw materials for cell and battery component production, developing qualified personnel, and increasing innovation in the supply chain.

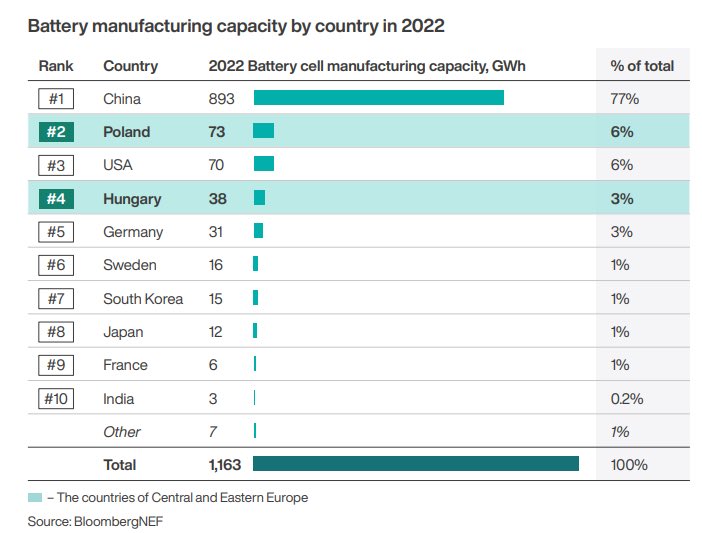

Poland has a chance to maintain its position in the face of an expected eight-fold increase in lithium-ion battery production capacity over the next five years, according to the PSPA report. Bloomberg NEF forecasts that global battery production capacity will reach 8,945 GWh in 2027, with Poland and Hungary accounting for 9 percent of that. Both countries will maintain high rankings, with Poland ranking 6th and Hungary ranking 4th in the world by 2027.

LG Energy Solutions Wrocław in Biskupice Podgórne, Europe’s largest electric car battery production center, currently has a production capacity of 86 GWh, which will soon reach 115 GWh. To maintain Poland’s leading position, doubling production capacity to over 200 GWh is necessary by 2027, according to PSPA’s Director of External Relations Aleksander Rajch.

The PSPA report emphasizes that lithium is a crucial raw material, but strengthening the European value chain for this element is currently a significant challenge. There are significant lithium resources in Europe, but many commercial mining operations are still in the preparation phase.

The growing demand for batteries means an increase in the need for skilled workers. The European Commission expects up to 4 million new jobs to be created by 2025, with 800,000 workers receiving training.

Maria Majewska of PSPA suggests creating a comprehensive support program for the battery sector, including training in new skills, talent development, and retraining of the current workforce, to provide potential investors with access to skilled workers.