More often than not, Poles are encountering gas stations where the price of a liter of fuel costs PLN 6.00 (€1.30). Expert forecasts are not offering any hope for decreases in prices any time soon and what’s worse, many are pointing to prices becoming even higher.

Criticism for the current state of affairs is often directed towards the government. When asked about the skyrocketing prices of fuel, Prime Minister Mateusz Morawiecki underlined that the situation was the result of speculation on the oil market. With a surge in central bank money printing and other factors outside Poland’s control, rising gas prices are a European-wide phenomenon. At the same time, he noted that the prices at Polish gas stations were among the lowest in Europe. While this is true, he did not add that the price growth of fuel in Poland was much higher than the average in the European Union.

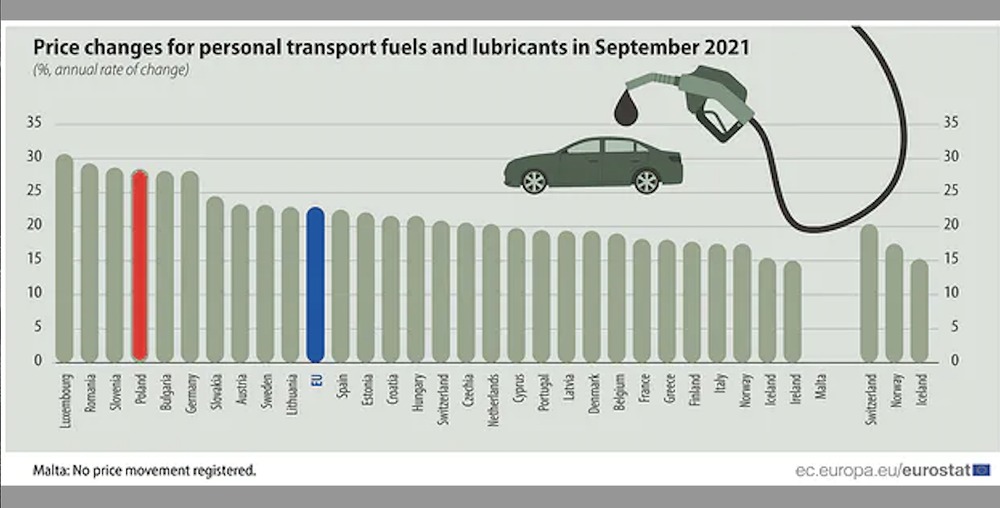

Eurostat data shows that in September 2021 gas prices grew quicker in only three countries in the EU other than Poland. The price growth was 28 percent year-to-year in Poland. The number was the same in Slovenia while in Romania the growth was 29 percent and in Luxembourg it exceeded 30 percent.

Similar price growth to that in Poland has also taken place in Bulgaria and Germany. Prices are increasing a few percentage points slower in Sweden, Spain, Hungary and Czechia, although these countries are still oscillating around the 22 percent EU average.

The EU states which have experienced the smallest price growth are Ireland and Iceland but even there prices have gone up by 15 percent year to year.

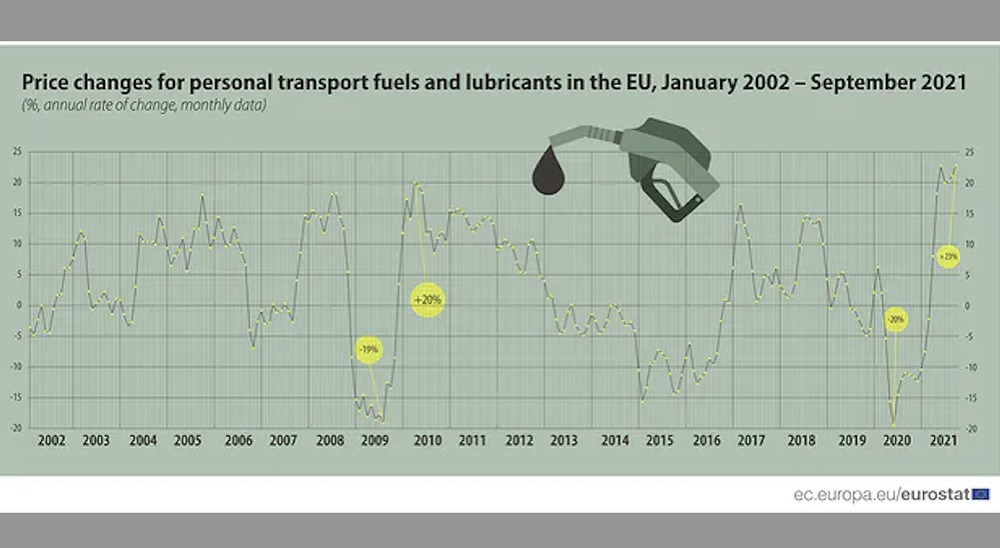

In the 21st century, there have been many periods in which Europe faced significant fluctuations of fuel prices. Nevertheless, these increases had always been limited to around 20 percent. Now, the changes are far greater, revealing the scale of the crisis.

The issue with rising prices of fuel stems mainly from oil becoming more expensive on the global stock markets. Since the start of the coronavirus crisis, the largest fuel producers have been limiting supplies of the resource while demand for it has grown insurmountably. Economic recovery and the energy crisis have resulted in demand exceeding supply.

According to Goldman Sachs analysts, there are certain factors pointing to a further increase of oil prices which may exceed even $90, with a barrel of oil in the United States currently costs around $85.

Moreover, the analysts suggest that given the continuation of the current policy of the Organization of the Petroleum Exporting Countries (OPEC), oil prices would have to reach $110 in the first quarter of 2022 to balance out the market. This is, however, the worst-case scenario.