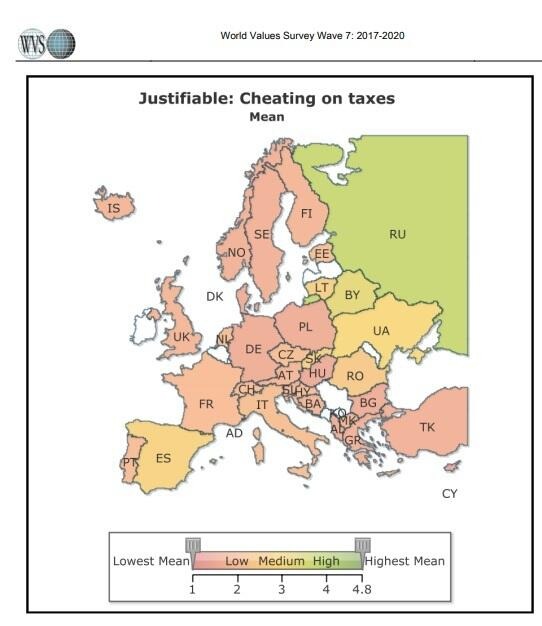

The most recent World Values Survey Wave 7 for 2017-2020 has shown a substantial change in how Poles judge taxation.

According to the survey, 76.4 percent of Poles believe that tax fraud can never be justified. This is a very good result compared to other countries in the region such as Czechia (61 percent), Slovakia (43 percent), and Lithuania (46 percent). Even Germany, where 76.2 percent believe tax fraud is never justified, came in below Poland, despite Germany typically viewed as one of the countries with the lowest rates of corruption in the world. According to the survey, Russians are the least likely to say that tax fraud can never be justified.

The result itself is not the only impressive aspect of the survey. The change which Poles have undergone regarding their perception of tax fraud is just as impressive. In comparison, during the previous survey wave (2010-2014) only 52.9 percent of respondents claimed that tax fraud could not be justified.

“One of the many indicators which illustrate tax morals is the index of citizens of a state who believe that tax fraud is permissible,” the Polish Economic Institute weekly publication, Tygodnik Gospodarczy, explained. The World Values Survey waves are conducted every few years, with the previous wave taking place between 2010 and 2014.

In the period between the survey waves, Law and Justice (PiS) took over power in Poland and immediately announced a fight against tax fraud and the gray tax zone. In 2016, the government established the National Revenue Administration which was directed to bring down huge tax frauds who, as PiS representatives explained, were hiding “behind the cover of economic activity.”

According to the government’s calculations at the time, arrears in VAT tax collection amounted to over €2.62 billion by the end of 2011. At the end of 2015, this sum had risen to €9.31 billion.

During that period, PiS also introduced a clause against tax evasion and amended the penal code by adding a punishment of up to 25 years of prison for large-scale tax extortion.

World Values Survey (WVS) is a global research project as part of which scientists have been measuring and verifying interests, values and convictions of the inhabitants of particular countries.